Blog detail

Why Landlords Should Not Make ‘Kacha Khata, Pakka Khata’?

In Nepal, landlords record their tenants’ details and their rental payments. But it is a little-known fact that landlords hold two types of record books/khata. These record books are known as ‘Kacha Khata and Pakka Khata’.

But what exactly are these Khatas? Do they have any significance? What are the legal consequences of keeping such records? We will cover all these aspects in this blog. Let’s dive right in!

What is ‘Kacha Khata, Pakka Khata’?

Kacha (कच्चा) means raw in Nepali. In the context of rental record keeping in Nepal, a Kacha Khata ( कच्चा खाता) is basically a notebook containing the rental payment agreed upon by the tenant and landlord.

Kachha Khata holds the actual record of rental transactions between the homeowner and the renter.

Pakka( पक्का) refers to surety in Nepali. Pakka Khata (पक्का खाता), in rental record keeping, means the rental payment record maintained by the homeowner and presented to the local authority.

Basically, Kacha means personal/unofficial rental record, while Pakka Khata means a record given to legal bodies or an official record.

Why do Homeowners Keep Kachha-Pakka Khata?

Maintaining Kachha–Pakka Khata is a loophole strategy that landlords have been following to evade taxation. The actual rental payment records in Kachha Khata with higher income are kept informally, while the lower income is presented in Pakka Khata and shown to the legal authority. The landlord presents the Pakka Khata for purposes like property valuation, loan applications, or to show limited taxable income.

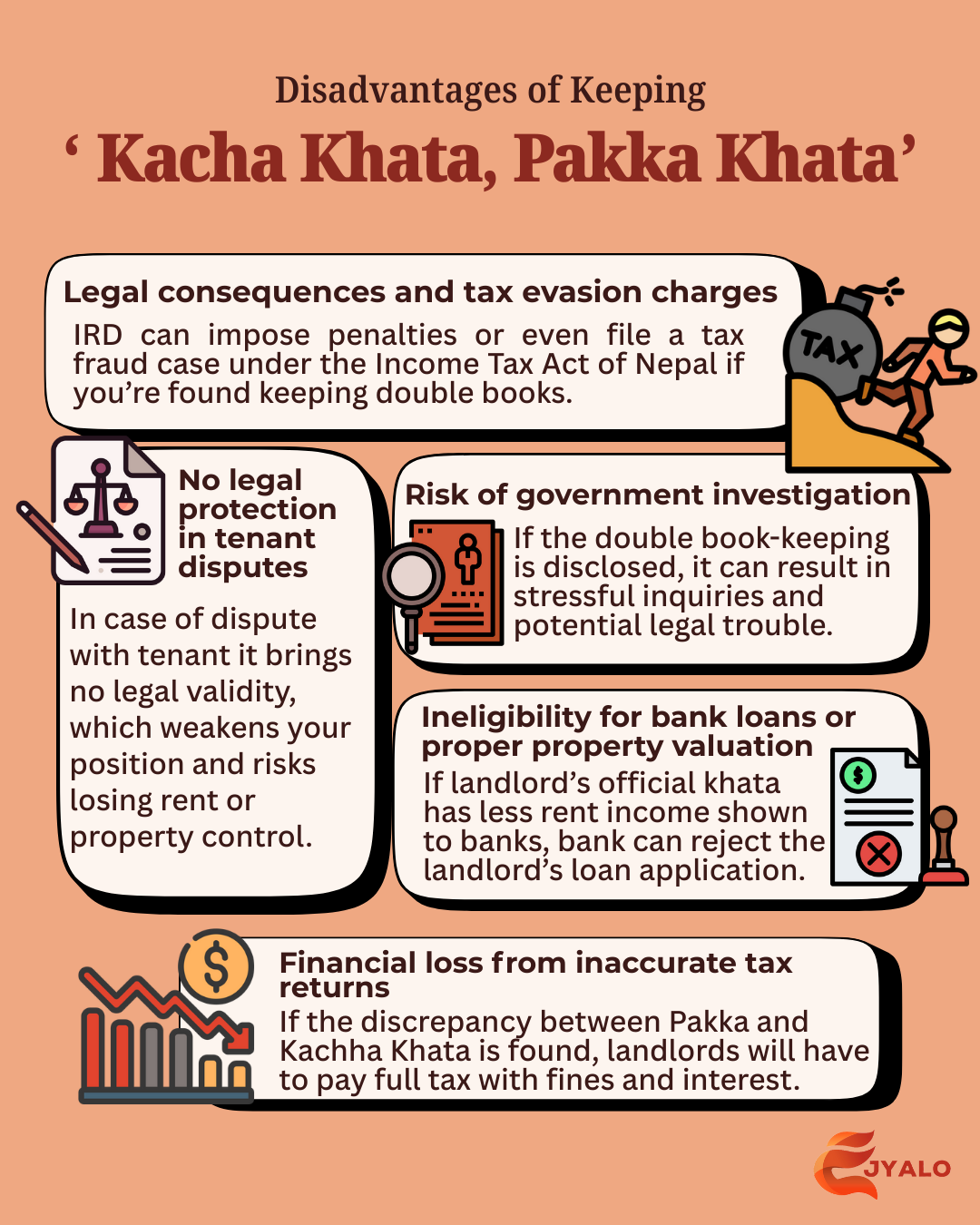

Disadvantages of Keeping ‘ Kacha Khata, Pakka Khata’.

In most cases, Kachha Khata and Pakka Khata records differ drastically from each other, as landlords attempt to maximize their profits. To some extent, this strategy can work, but in the bigger picture, it can cause lots of problems for the homeowner.

Let’s look into the disadvantages of having ‘Kacha Khata, Pakka Khata’.

Legal consequences and tax evasion charges

If a landlord collects more in the Kacha Khata (unofficial record) while stating a low rental amount in the Pakka Khata (official record), this is considered tax evasion. If this gets revealed to the legal body, the Inland Revenue Department (IRD) can take legal action. IRD can impose penalties or even file a tax fraud case under the Income Tax Act of Nepal.

No legal protection in tenant disputes

Disputes arise when a tenant refuses to pay rent, damages property, or overstays. As a landlord, you may threaten them to evacuate or take strict action. In such cases, the tenant can file a case against you. If things aren’t settled outside the court, you have to show your Kacha Khata, which is inconsistent with Pakka Khata. It brings no legal validity, which weakens your position and risks losing rent or property control.

Risk of government investigation

By any source, if the inconsistencies between Pakka Khata and Kacha Khata are disclosed, it can raise suspicion during audits. This inspires the related local government or tax offices to make a detailed investigation. The legal bodies can ask for documents or even check your bank and property records. This can result in stressful inquiries and potential legal trouble.

Ineligibility for bank loans or proper property valuation

In Nepal, landlords can present their rental income when applying for property loans, refinancing, or business loans from banks. If landlords have less rent income in their Pakka Khata, banks can get an idea of the landlord having a low income. Such a conclusion leads the bank to reject the landlord’s loan application. Eventually, this stops landlords from using their property to get money for plans.

Financial loss from inaccurate tax returns

If landlords show less rent income to save tax or file for a tax return, it can backfire. If the discrepancy between Pakka and Kachha Khata is found, landlords will have to pay full tax with fines and interest. Also, the IRD in Nepal reviews past years' returns, which causes long-term financial loss and harm to the landlord’s reputation.

What to do instead of keeping ‘Kacha Khata, Pakka Khata’?

Adopting the‘Different Kacha Khata and Pakka Khata’ system is full of risks for the landlords. Thus, the necessary precaution has to be taken.

Landlords should prepare a detailed rent contract from the beginning. A rent contract includes details such as: How much rent is to be paid?

When should the rent be paid?

What do both the landlord and the tenant agree to?

What action can be taken in case rent isn’t paid on time?

The signed rental contract serves as a shield for landlords in relevant legal matters and tax purposes.

Confused or stressed about drafting the rent contract from scratch? Well, eJyalo has your back. We have drafted a detailed rent contract for landlords in Nepal. The best part is that the contract is available in Nepali, which is the official language of Nepal.

You can simply download the eJyalo rent contract and use it for yourself. With this simple effort, the chances of staying protected and organized are high.